How to Insure Valuable Personal Property

Updated June 7, 2019 . AmFam Team

You’ve invested a lot in your home and all the things in it. If you own your home, you know your homeowners insurance covers things like fire damage and vandalism, but you might be wondering if it’ll cover your wedding ring or your brand-new leather couch. That’s where personal property insurance comes into play.

Personal property and valuable personal property insurance are two kinds of coverage you may have on your homeowners insurance that can help you protect the value of your personal belongings. These policies can insure your valuables up to a certain amount, and in some cases, they may even cover the full replacement cost of those valuables.

Homeowners insurance might cover some loss or damage of belongings, but only up to a certain dollar amount. And if you want to protect the individual value of your belongings, scheduled personal property (or itemized personal property) insurance is the way to go. We’ll help you understand the different types of personal property insurance and what they cover.

Protecting Your Valuables

So, what exactly can personal property insurance help protect? Generally, it can cover your personal belongings, like your home’s furniture, your jewelry, clothing, art and any musical instruments you might own. “Personal property” can mean almost anything that’s not real estate. Not sure if some of the things you own are considered personal property? Contact your American Family Insurance agent to find out.

Items defined as personal property are generally covered under what is called a “named peril” basis. A named peril is a specific kind of hazard listed in your insurance policy. These hazards are what apply to your personal property, and any other hazard that occurs will not be covered under your policy.

For example: your wedding ring is stolen from your home while you’re out at the grocery store. Your personal property insurance lists “theft” as a named peril, and so the loss of your ring is covered. If, however, the ring was simply lost and your coverage does not list “loss” as a named peril, your ring would not be covered.

Some homeowners insurance has a version of personal property insurance called “open peril” coverage. This means that your personal property is covered for any hazard not specifically excluded by the policy. Because of the somewhat universal nature of this kind of personal property insurance, open peril coverage tends to be more expensive.

It’s a good idea to take stock of the valuables in your home so you know how much insurance coverage you need. Some personal property insurance is divided by what kind of items it insures, so we’ll get into a few of the specific types next.

What is musical instrument insurance?

Many homeowners insurance policies cover less expensive instruments, like your daughter’s secondhand clarinet for band class, up to $2,000 in the event of accidental damage or theft. But if you have an instrument, recording or audio equipment valued at over $2,000, a separate policy might be in order.

Musical instrument insurance covers familiar instruments like pianos, electric guitars, tubas and violins. You can also insure amplifiers, mixers and microphones that you use to record or perform with. If you’re a DJ, you may even be able to insure your turntables.

While theft is usually covered, you’ll want to look into exactly what kinds of damage these policies cover. For example, some musical instrument insurance may cover fire but not water damage. It’s a good idea to know the specifics of any policy you buy.

Applying for musical instrument insurance will require a bit more paperwork than other types of insurance. You’ll need specific details about the cost of the instrument, how often it’s used, if it travels, where it’s stored and more. But protecting an expensive, beloved instrument is definitely worth a little extra legwork.

How do I insure my art and antiques?

If you have an art collection or priceless antique family heirlooms, you want to know your belongings are covered if they’re stolen or damaged. That’s where art insurance, also known as fine art insurance, and antiques insurance come in. These are two different kinds of insurance meant to help you recover the value of your belongings.

Art insurance is usually used by collectors, but if you’ve come into ownership of a painting or a set of sculptures that you want to insure, this is the kind of insurance to get. If you don’t have the receipt that proves your purchase or the value of these items, you’ll need a professional appraisal to confirm their value. If the items were purchased or inherited many years ago, you will also need a professional appraisal. This is because the current market value and depreciation of the art needs to be accounted for before it can be insured.

Antiques insurance follows similar principles to art insurance. An antique piece of furniture or collector’s item will need to be assessed for its age, firstly to prove its status as an antique and secondly to help prove its value. For both art and antiques, you’ll want to have photographs of your pieces along with a fully itemized list of everything you need insured.

In the case of high-value art or antiques, a second appraisal may be required by your insurance company to confirm the value stated by the appraiser you hired. Once the value is accepted, you can insure your art and antiques either with their own separate policy or by scheduling them under itemized coverage.

What is furniture insurance?

Your furniture may already be covered under your homeowners insurance up to a certain value, but if it isn’t and you’d like it to be, you’ll want to consider furniture insurance. This insurance specifically covers damage or loss of furniture from your home and can be added in the form of scheduled (or itemized) coverage, or as a separate policy if your furniture is of particularly high value.

You may be familiar with furniture insurance as retailers offer it — a “protection plan” on your furniture that reimburses you for damage done during a certain time period. They may even cover repairs and total replacement. Furniture insurance as offered by insurance companies, however, differs in its comprehensiveness and cost. Personal property insurance often covers a lot more types of loss and damage than a furniture store’s protection plan, and it won’t cost you a few hundred dollars up front to get.

What about my other valuable things?

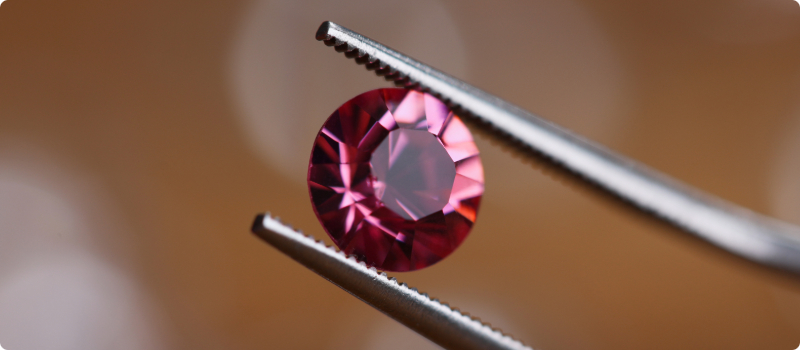

Insuring your collectibles, jewelry and other valuables is similar to the other types of insurance covered above. You can add more protection to your homeowners insurance by increasing your total coverage limit, scheduling your individual pieces of jewelry under a scheduled policy or buying separate insurance that covers solely the items you’re looking to insure.

Homeowners insurance may cover your jewelry, coin collection, heirloom pins and other valuables, but it may only cover specific kinds of valuables. For example, some homeowners insurance will say that it covers jewelry, but what it means is that it only covers your wedding ring, engagement ring and diamond jewelry. It may not cover a pair of gemstone earrings you just purchased or other unspecified types of jewelry. It’s important to speak to an agent about exactly what items are covered so you know if you need an extra policy for your pieces.

How to Estimate the Value of Your Personal Property

Estimating the value of your personal property might seem like a daunting task, especially if you own a lot of stuff, but it’s well worth it to understand just how much insurance you need.

Itemizing the items in your home is the first step to understanding their value. If you keep receipts, now’s the time to break them out and start adding them up. List the purchase date for each item, and keep in mind that depreciation may come into play if you make a claim. Don’t forget to take photos of each item so you have a record of their condition at the time you assessed them.

If you come across items you inherited with no record of their value, you may need to take them to an appraiser or hire one to come to your home to make an assessment. As mentioned earlier, your insurance company may require a second, separate appraisal to accept the value before insuring the items.

Once you have all your belongings added up, you can begin the process of figuring out what your homeowners insurance will cover in totality and what should be itemized and scheduled for further protection.

Scheduled Personal Property Coverage

If you have antiques, heirloom jewelry or other items with high monetary and sentimental value, you may want to consider adding scheduled personal property coverage to your homeowners insurance. Scheduled personal property (or itemized personal property) coverage applies to individual items within your personal property coverage to better protect their value from loss or damage. When you schedule an item, you insure it for its replacement cost, unaffected by depreciation or limited by the liability coverage amount in your homeowners insurance.

Scheduled personal property coverage costs extra to add to your policy, but it has many benefits that make that cost worth it. When making a claim on scheduled property, there is usually either a low deductible or no deductible at all. Scheduled items are also covered on an open perils basis, meaning as long as it’s not explicitly excluded by the policy, any type of loss or damage is covered.

Personal property insurance is an important feature of homeowners insurance that helps you protect yourself financially from the loss of your property. Still have questions? Contact your American Family Insurance agent. They can help you figure out if you need more personal property coverage, what is covered by your existing policy and set you up with scheduled personal property coverage if you’ve got valuables that need it.

This information represents only a brief description of coverages, is not part of your policy, and is not a promise or guarantee of coverage. If there is any conflict between this information and your policy, the provisions of the policy will prevail. Insurance policy terms and conditions may apply. Exclusions may apply to policies, endorsements, or riders. Coverage may vary by state and may be subject to change. Some products are not available in every state. Please read your policy and contact your agent for assistance.